Trade and crafts play a central role in the Austrian economy: the economic contribution can be quantified as 236,000 businesses, around 800,000 employees and 101.9 billion euros in net sales in 2019. Covid-19 has also left its mark here. The WKO, Federal Division for Trade and Crafts, together with KMU Forschung Austria and the Economica Institute of Economic Research, has investigated the economic damage and surveyed the countermeasures businesses have taken. The sustainability of the losses in sales and earnings is analyzed in an outlook.

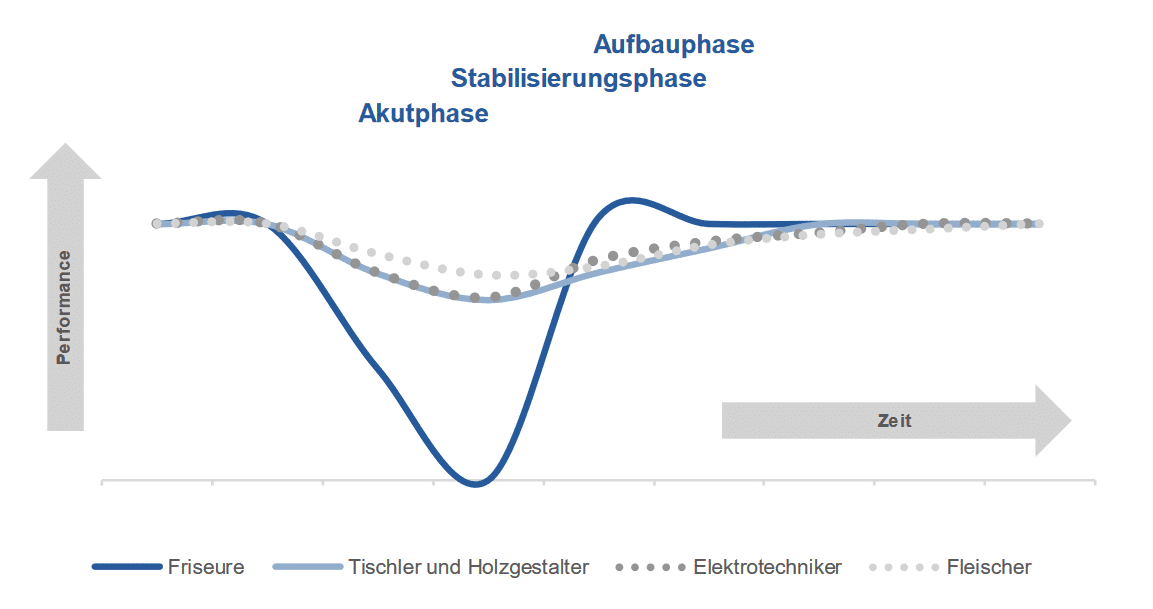

As expected, the order situation and sales recorded a sharp decline, averaging -21% in March, -31% in April and -17% in May. The total loss of sales from March to May 2020 amounts to 5.8 billion euros or 5.7% of annual sales. Within the division, significant differences between sectors can be observed. Sectors with a strong focus on the end consumer, such as health/wellness and creative/design, were hit the hardest, while companies that supply other businesses were affected the least. While hairdressers suffered a drop in profits of almost two thirds, carpenters and wood designers were affected by a reduction of almost half. Electrical engineers and butchers each saw their profits fall by a third.

Typical Covid-19 crisis phases of selected sectors in trade and industry, source: Economica

Although almost all companies took measures, there is a massive drop in profits. In numerous sectors of the skilled trades and crafts, the resulting entrepreneurial wage in 2020 remains below the collectively agreed minimum wage. The reduction of vacation and overtime as well as Covid 19 short-time work were the most important measures, and were implemented by about half of the companies. Costs and liquidity were also saved by 36% and 31% respectively by not purchasing goods, materials and external services and by canceling investment projects. Tax deferrals, applications to the Hardship Fund and deferrals or installment payments for social security were also among the bridging measures taken.

The strategies adopted and the lifting of the lockdown have led to an initial improvement: 22% of the companies have already returned to the pre-crisis level. Two thirds of the companies expect a recovery from September to November 2020. However, one third do not see a return to the pre-crisis level of orders and sales until 2021 or later. The financial burden is also clearly reflected in investment planning: in January, around half of commercial and craft enterprises still wanted to make investments in the current year. In May, the figure was only 21%.

On a positive note, the four commercial and craft sectors analyzed will (on average) continue to generate profits in 2020 despite the Covid 19 pandemic. This shows that the business models in the trade and craft sectors are "crisis-proof" in key areas - depending, of course, on their position in the value creation process.

Applied methods

The SME Research Austria conducts four times a year the Business Cycle Observations trade and industry. In the 2nd quarter of 2020, additional questions were asked about the impact of the coronavirus pandemic in the period from the end of March to the end of May 2020. Responses from 1,267 companies were included in the data analysis. The inter-firm comparison using business ratios was based on the Balance Sheet Database of SME Research Austria.

In the scenario analyses are taken into account measures taken by the commercial and craft enterprises to improve the cost situation (eg short-time work to reduce personnel costs). Based on the affectedness of the selected industries, the phases of the crisis are analyzed, in order to subsequently present the scenarios on the business impact of the Corona crisis in detail.

Your contact for queries

Mag. Peter Voithofer

Tel.: +43 664 822 85 60

Mail: peter.voithofer@economica.eu